Your marketing budget is on fire. Customer acquisition costs have surged 222% over the past eight years—from $9 to $29 per customer—while lifetime value stays stubbornly flat. Unit economics that once delivered comfortable 5:1 LTV-to-CAC ratios have collapsed to barely-viable 2:1 margins.

Global ad spending hit $1.1 trillion in 2024, yet 74% of CMOs are under intense CFO pressure to prove ROI (Gartner 2024). The breaking point isn't coming—it's already here.

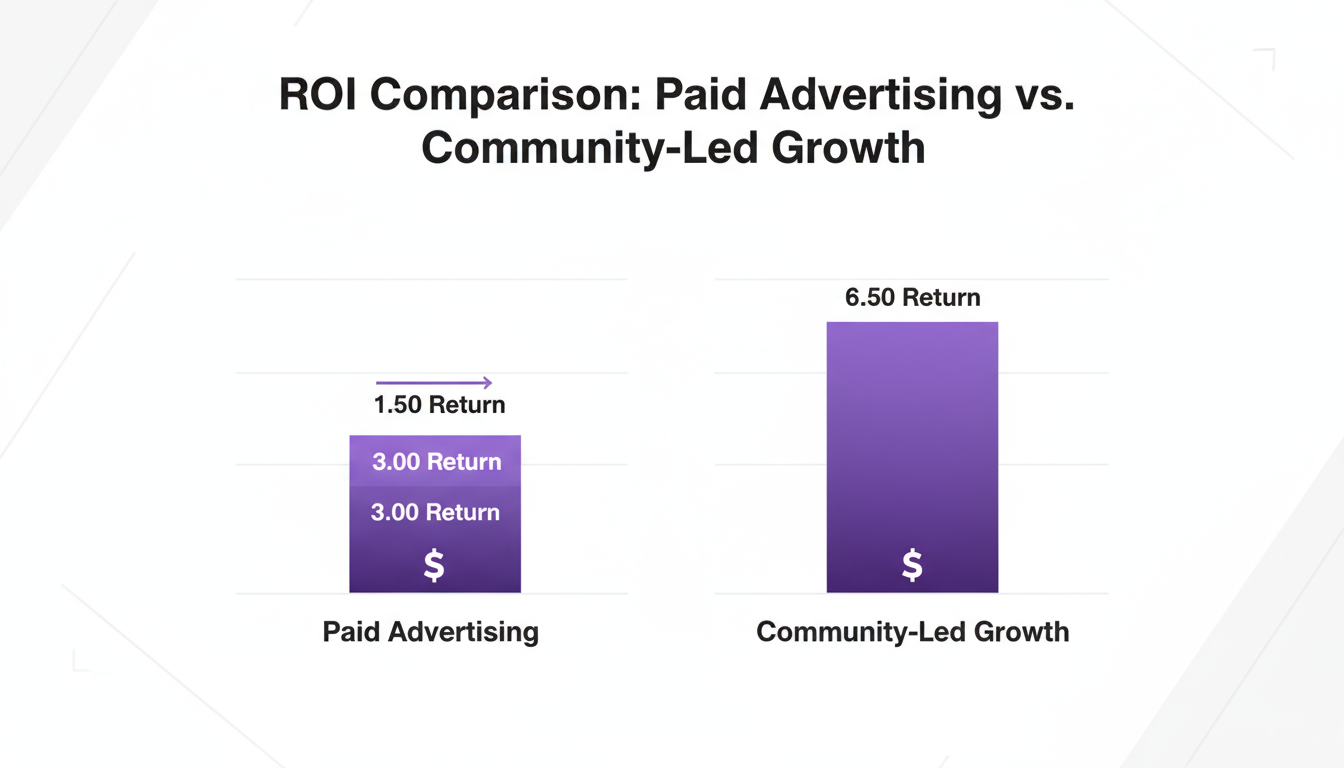

But while most CMOs throw more money at Facebook and Google, a quiet revolution is happening. Brands like Starbucks, Sephora, and Duolingo have cracked the code: community-led growth delivers $6.50 for every $1 spent (WiserNotify 2025), compared to $1.50-$3 returns from paid advertising (FirstPageSage 2024). They've transformed customers from cost centers into acquisition channels.

This isn't theoretical. It's proven at scale with enterprise infrastructure, behavioral science research, and CFO-ready financial models. Here's how the economics work—and why you have 18-24 months before this becomes table stakes.

the CAC crisis explained

Customer acquisition costs are accelerating across every industry:

- SaaS: $239 average CAC, up 60% since 2019

- DTC/E-commerce: $45-$200 CAC, up 25-40% in 2024 alone

- B2B: $536 average CAC

The drivers are structural. Facebook's average CPC increased 200%+ since iOS 14.5 decimated targeting precision. GDPR reduced addressable audiences by 12.5-40%, forcing premium rates for lower-quality traffic. When consumers see 4,000-10,000 ads daily, click-through rates plummet while costs soar.

When CAC approaches lifetime value, unit economics collapse. Spending $200 to acquire a customer worth $250 leaves $50 for fulfillment, support, overhead, and profit.

You're not failing at execution. The system itself has become unsustainable.

the hidden CAC multiplier: churn amplifies everything

High customer acquisition costs become catastrophic when combined with high churn:

- E-commerce averages 70% annual churn

- Only 28.2% of customers make repeat purchases

- SaaS companies lose 3.5% monthly (35% annually)

Harvard Business Review's Frederick Reichheld proved that 5% churn reduction drives 25-95% profit increases. Consider the treadmill: If you have 100,000 customers and 70% annual churn, you lose 70,000 customers per year. At $50 CAC, that's $3.5 million just to stand still. Reduce churn by 25% and you save $875,000 in avoided acquisition costs.

Duolingo increased next-day retention to 55% (vs. 5% industry average), driving revenue from $13 million (2017) to $161 million (2020)—a 1,138% increase. When they reduced churn from 47% to 37%, analysts estimated valuation impact exceeded $300 million.

Starbucks Rewards: 75 million members drive 57% of company sales ($13.15 billion annually), delivering 5.2x ROI because retention mechanics reduce constant acquisition needs.

Retention isn't a defensive strategy—it's an offensive CAC reduction weapon. Every percentage point of churn you eliminate translates directly into acquisition dollars you don't need to spend.

enter Community-Led growth: the $6.50 ROI alternative

Community-led growth represents a fundamental shift: instead of renting attention from platforms, you cultivate owned audiences that generate compounding returns.

Community-led growth delivers $6.50 for every $1 spent vs. $1.50-$3 paid ads.

That's 2-3x better returns—at scale, this translates to hundreds of millions in enterprise value.

CLG emerged around 2020-2022, driven by companies like Notion, Figma, and Atlassian. CMX Institute (2024) found 87% of community leaders now consider community "critical" to business strategy, up from 43% in 2019.

The framework rests on three pillars:

- Viral Referral Mechanics: Transform customers into acquisition channels

- User-Generated Content Amplification: Replace paid creative with authentic content that converts 4x better

- Retention Optimization: Deploy behavioral science to extend customer lifetimes

the trust advantage

83% of consumers trust personal recommendations, while only 33% trust brand advertising (Nielsen). Referral programs deliver:

- 25% higher profit margins

- 16% higher lifetime value

- 86% more revenue growth year-over-year

- 67% higher retention rates

proven at enterprise scale

Starbucks Rewards: 75 million members, 57% of sales, 5.2x ROI. The program creates a zero-cost acquisition channel as members recruit friends.

Sephora Beauty Insider: 25 million members drive 80% of company sales. Members spend 10x more than non-members. Sephora reduced paid acquisition spend by 40% while growing faster than category averages.

Duolingo: 55% next-day retention drove 200% revenue growth (2017-2020), valuing the company at $2.4 billion by 2021.

Nike Run Club: 88% retention rates vs. 20-30% for traditional gyms. Nike's DTC revenue exceeded $16 billion in 2023, with community members showing 3-4x higher purchase frequency.

For brands looking to optimize user acquisition strategies, the evidence is overwhelming.

turn customers into acquisition channels

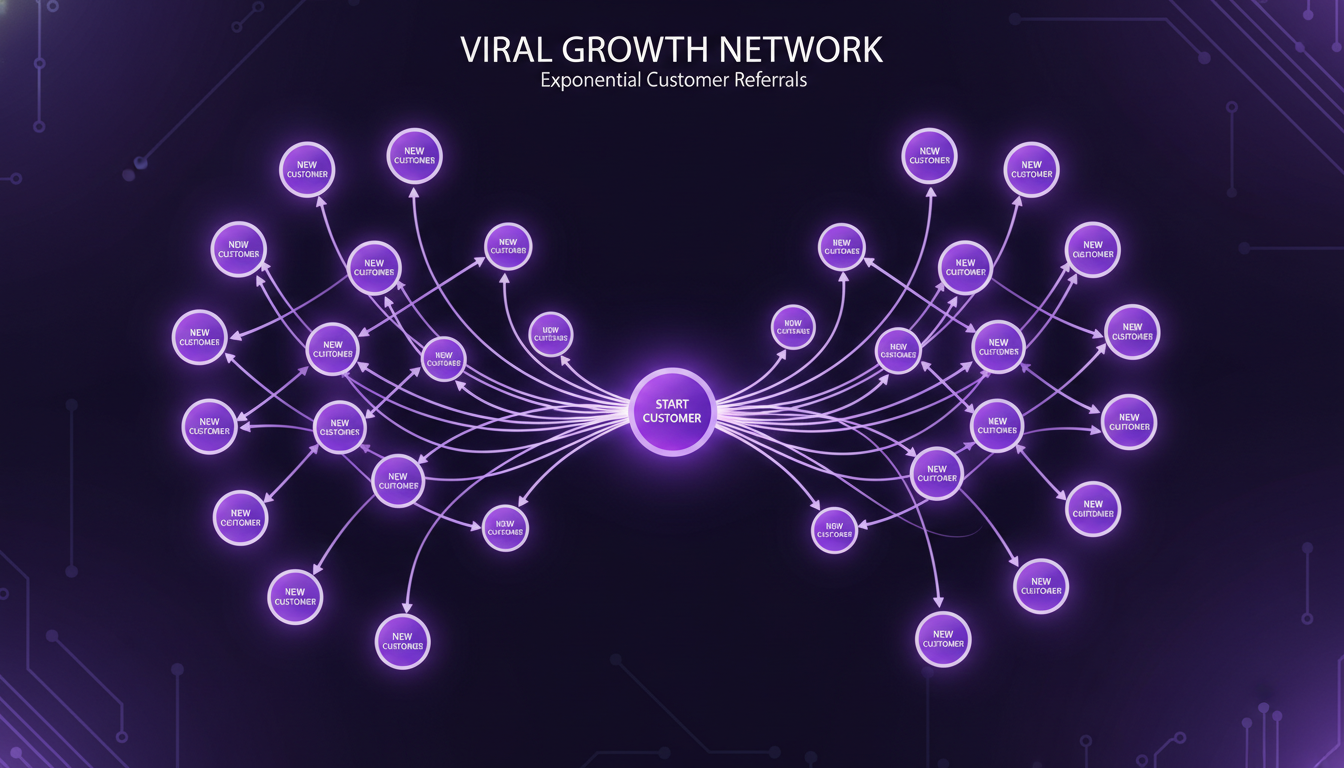

The most sophisticated CLG programs engineer viral growth loops using network effects and behavioral psychology.

viral referral economics

Properly structured referral programs achieve 45% CAC reductions while increasing LTV by 2-3x. Referred customers cost only the referral reward (typically $10-50), compared to $50-200 in paid media costs.

K-factor measures viral growth: if K=1.0, each user brings one additional user. Most sustainable businesses target K-factors of 0.2-0.7. At 0.5 K-factor, every 100 acquired customers yield 50 additional organic customers (50% blended CAC reduction).

Historical precedent:

- PayPal: $70 million drove 1M to 50M users. Valuation at acquisition: $1.5 billion. ROI: 21-25x

- Tesla: 40-119x ROI by converting customers into brand advocates

- Dropbox: 3,900% user growth while reducing CAC by 60%

user-Generated content as paid media replacement

The UGC market is exploding: from $7.37 billion (2024) to $57.92 billion by 2032 (29.4% CAGR), driven by:

- 4x higher click-through rates vs. brand content

- 200% conversion rate increase on product pages

- 93% of marketers prefer UGC over branded content

Glossier built a $1.4 billion valuation almost entirely through UGC. Modern CLG platforms enable 300% increases in social sharing by gamifying content creation.

the behavioral science behind It

Community-led growth is applied behavioral psychology backed by decades of research:

- B.F. Skinner: Variable reward schedules create stronger behavioral patterns

- Daniel Kahneman (Nobel Prize 2002): Loss aversion makes people work harder to avoid losing something

- Robert Cialdini: Social proof, commitment/consistency, and reciprocity drive decisions

The gamification market is growing from $20.84 billion (2025) to $190.87 billion by 2034. Current adoption sits at 43%, with forecasts projecting 70%+ by 2027 (Gartner).

case study: Duolingo's behavioral science stack

Duolingo layers multiple psychological principles:

- Variable Rewards (Skinner): XP bonuses vary unpredictably

- Loss Aversion (Kahneman): Streaks create loss aversion

- Social Proof (Cialdini): Leaderboards normalize daily engagement

- Endowed Progress Effect: Partial progress increases completion rates by 300%

Result: 55% next-day retention (vs. 5% category average), compounding into $300 million+ in valuation impact.

prove It to your cfo: the business case

CFOs kill marketing initiatives that can't demonstrate clear ROI. Community-led growth survives scrutiny because it generates revenue.

cFO-Ready financial model

Conservative Year 1 projection for a mid-sized DTC brand ($20M annual revenue, 50,000 customers):

Investment:

- Platform cost: $48,000/year

- Community manager: $80,000/year

- Creative/campaigns: $32,000/year

- Total: $160,000

Revenue Impact:

- Churn reduction (25%): $312,000 saved acquisition costs

- Referral revenue (8% referral rate): $200,000

- LTV increase (15%): $150,000

- UGC content replacing paid creative: $100,000 savings

- Total: $762,000

Year 1 ROI: 376% return or 4.76x Payback Period: 2.5 months Three-Year NPV: $1.78 million Three-Year IRR: 287%

Modern analytics platforms track community-to-revenue attribution using cohort analysis, holdout testing, and propensity score matching.

You have 18-24 months before this becomes table stakes.

build vs. buy: the economics

the Build-In-House path

Engineering teams estimate $1.5 million over three years to build enterprise-grade community infrastructure, requiring 6-12 months before launch. Hidden costs include opportunity cost, compliance maintenance (SOC 2, GDPR, CCPA), and scaling costs.

the platform path

Enterprise community platforms cost $356,000-$396,000 over three years with launch in 4-8 weeks. Advantages include built-in compliance, continuous updates, proven behavioral science frameworks, pre-built integrations, and infrastructure handling 10M+ users.

Savings: $1.1M+ (73%) with dramatically faster time-to-market.

The strategic question: Would $1.5 million in engineering time deliver more value building community infrastructure or building product features that differentiate your core offering?

can this scale? enterprise infrastructure

Enterprise CMOs ask: "Will this work at 500,000 customers? 5 million?"

Starbucks Rewards: 75 million active members. Sephora Beauty Insider: 25+ million members. Nike Run Club: 100+ million downloads.

Modern platforms support 10 million+ concurrent users with 99.97%+ uptime, sub-200ms response times, SOC 2 Type II compliance, GDPR/CCPA compliance, and 32+ language localization—production requirements for enterprise solutions serving Fortune 500 companies today.

the urgency: why now matters

Customer acquisition costs aren't stabilizing—they're accelerating. Current trajectory models suggest 40-60% further inflation by 2027. If your CAC is $50 today and inflates 50%, you're paying $75 per customer. At 10,000 annual acquisitions, that's $250,000 in additional cost—every single year.

the competitive window

Current adoption sits at 43%, projected to reach 70%+ by 2027. We're in the Early Majority phase:

- Early Majority (34%): 2025-2027 ← WE ARE HERE

- Late Majority (34%): 2028-2030 - Table stakes

- Laggards (16%): 2031+ - Forced adoption

By 2028, community-led growth will be like having a mobile app—expected, not differentiating.

first-Mover advantages

Early implementation captures customer habit formation, network effects, data advantages, cost arbitrage, and cultural integration. Starbucks launched Rewards in 2009; by 2015-2016, they had 75 million members and billions in behavioral data—an insurmountable moat.

Historical precedent shows 18-24 month windows where adoption delivers asymmetric returns, followed by commoditization as penetration exceeds 70%.

We're 18-24 months into the community-led growth wave. The window is open. But not for long.

conclusion: the economics have changed forever

Customer acquisition costs have increased 222% in eight years while paid advertising ROI has collapsed. CAC will inflate another 40-60% by 2027.

Community-led growth solves the fundamental problem:

- $6.50 per $1 invested (vs. $1.50-$3 paid ads)

- 45% lower CAC through referral mechanics

- 2-3x higher LTV through retention optimization

- 5.2x average ROI across loyalty programs

- 4-6 month payback periods

This isn't theory. It's proven at scale:

- Starbucks: 75 million members, 57% of sales, 5.2x ROI

- Sephora: 80% of sales from members spending 10x more

- Duolingo: 55% next-day retention, $300M+ valuation impact

- Nike: 88% retention rates, $16B+ DTC revenue

The question isn't technical feasibility—it's strategic commitment.

You have 18-24 months before community-led growth becomes table stakes. Early movers capture outsized returns and build competitive moats. Late movers play expensive catch-up.

The CAC crisis isn't going away. But you don't have to be a victim of it.

ready to shift budget from paid ads to customer-driven acquisition?

Explore how leading brands are building community-led growth infrastructure or request a custom ROI analysis based on your current CAC, churn rate, and customer base.

The economics have changed. Your acquisition strategy should too.

Last updated: January 13, 2025